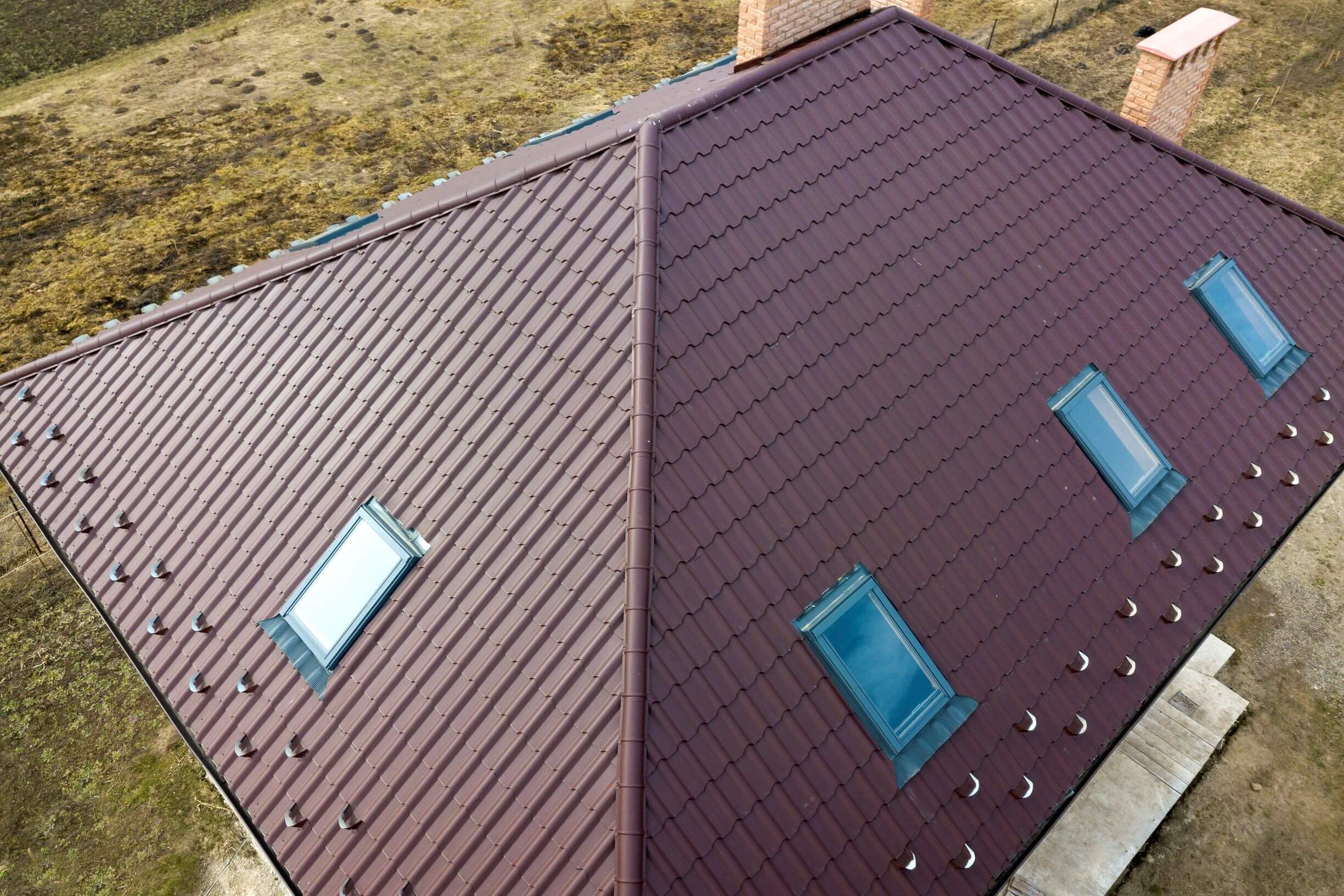

June 1 to November 30 is Houston’s official hurricane season. That means it’s time to protect your properties by contacting local roofing companies in Houston.

Any preparation you do before the storm season hits will make it easier on your home and business. Once you finish prepping your home and stocking up your emergency kit, also relook at the new tax laws.

“The Tax Cuts and Jobs Act (TCJA) sets new regulations that affect people and businesses.”

Fast Facts On Hurricane-Related Tax Relief

- Dedicated disaster-specific rules that enable the use of retirement funds

- Specific rules for approved disaster-related personal casualty losses

- Special rules to apply for disaster-relief provisions to possessions of the US

- Employee retention credits for Hurricane-affected business owners

- Provisional suspensions of the limitations for specific charitable contributions

- Specific rules for the earned income tax credit and child tax credit

Personal Casualty Loss

Hurricanes can be brutal to your homes, especially your roof. The hard rain may exploit the existing cracks, leading to significant leaks. Not to mention, they stir up much debris that may damage your shingles and clog your gutters.

Under these circumstances, you calling roofing companies in Houston is in your best interest. Well, for most homeowners and business owners, the big question remains – will you get a tax benefit?

Yes. The Internal Revenue Code allows you to claim federal income tax deductions in case of losses to your personal-use property.

“Here, casualty stands for any damage caused due to a sudden or unexpected event – like a hurricane.”

The Old Vs. New Tax Bill

Notably, if you’ve incurred uninsured losses worth more than $100 due to a natural disaster like a hurricane, you could claim tax benefits as per the old bill. But, this was applicable only when your total loss amount was more than 10% of your adjusted gross income.

However, effective from January 1, 2018, the new Disaster Tax Relief Bill has brought about new reforms. Now, you can only claim the deduction if the loss has occurred in a federally declared disaster, until 2025.

The Hurricane Tax Relief Bill

The Hurricane Tax Relief bill introduced in 2017 offers relief to the people who may be directly affected by hurricanes. The bill offers penalty-free access to retirement funds to rebuild assets damaged in a hurricane.

The law benefits millions of citizens in Texas, particularly Houston, in the following ways:

1. Home Damage

If a hurricane causes damage to your home, and you have property casualty losses, you can deduct the damages incurred on your taxes. This gives you a chance to rebuild your roofs or homes without worrying about finances.

Plus, you can contact roofing companies in Houston to help you cope with the damage faster and better.

2. Retirement Savings

When you need monetary funds to rebuild your property, dipping into your retirement savings might seem like a desirable option.

However, in a typical case, if you’re younger than 59, you’ll have to pay a 10% withdrawal penalty. Only if you’re a hurricane survivor, can you use your funds without a penalty as per the Tax Bill.

3. Offering Help

If the hurricane hasn’t caused any direct damage, but you’re aware of the tremendous losses, you can help other survivors in many ways.

The legislation removes the deduction limit on the amount you give for charities that are focusing on hurricane relief. Not only do these help victims with the necessary funds, but they also offer significant tax benefits. Your donation is tax-deductible when you make it to a qualified charitable organization.

4. Business Support

If the aftermath of a storm has affected your business, you can enjoy federal tax relief provisions. For any uninsured and un-reimbursed losses, you can deduct the losses on the year of the damage. There are also special rules to deduct casualty losses of inventory and products said for sale to customers.

“You get a tax credit for 40% of employee wages if you’re a disaster-affected employer.”

Tips To Prepare You Before And After A Hurricane:

- Talk to an IRS specialist who’s trained in handling hurricane-specific issues.

- Get a tax return copy of the prior-year returns

- Get a transcript online or by mail by submitting an online request

- Update your emergency plans, as disasters can strike at any time

- Create electronic copies of all critical documents. Keep a duplicate set in a waterproof container. These include: tax returns, bank statements, insurance policies, and identification documents.

- Document all home and business valuables through photos or videos. By doing this, it will be easier to claim insurance and tax benefits after the hurricane.

Guardian Roofing is One of the Most Truted Roofing Companies in Houston During Hurricane Season

Guardian Roofing understands the various liabilities that come with a storm. Apart from protecting your home and business, it would be best if you also considered tax liabilities and benefits. As one of the leading roofing companies in Houston, we help you throughout the process – right from preparing your roof and inspecting it in advance to repairing and replacing it after the storm.

Call us at 832-998-3458 today to discuss how we can help you!